How I Protected My Family’s Savings on Study Tours—No More Financial Surprises

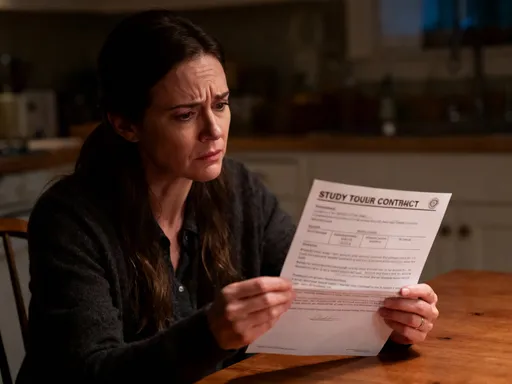

Every parent wants to give their child unforgettable learning experiences, and study tour programs can be life-changing. But behind the brochures and exciting itineraries, there’s a hidden financial reality many don’t see until it’s too late. I learned this the hard way—overpaying, facing last-minute fees, and nearly losing thousands. This is the real talk you won’t get from tour operators: how to enjoy educational travel without risking your family’s finances. What seemed like a straightforward investment in my child’s future turned into a stressful lesson in budget overruns, unclear contracts, and emotional decision-making. Now, I share what I’ve learned so other families can avoid the same pitfalls and make informed, confident choices.

The Hidden Costs Behind Educational Adventures

Study tour programs are often marketed as all-inclusive educational packages, but the advertised price is rarely the final cost. Families frequently discover additional charges only after signing up, when it’s harder to back out. These hidden fees can include mandatory insurance upgrades, meal supplements for dietary needs, transportation between cities not covered in the base fee, and so-called “optional” excursions that become social expectations among peers. One parent reported being told a $300 city walking tour was “highly recommended,” only to learn later that most students in the group had signed up—making their child feel left out if they didn’t join.

Why do these extra costs exist? Many providers use a pricing strategy known as “cherry pricing” or “bait pricing,” where the initial quote is kept low to attract interest, with the expectation that most families will add on services later. This creates the illusion of affordability while allowing companies to increase profits through add-ons. For example, a tour advertised at $4,500 might end up costing $5,800 once meals, travel insurance, visa assistance, and activity upgrades are factored in. Without a detailed line-item breakdown at the start, families have no way to compare true value across providers.

To protect against unexpected expenses, parents should request a full cost disclosure before committing. This includes asking for written confirmation of what is and isn’t included. Key questions include: Are all meals covered? Is airport transfer included at both ends? What happens if a student needs medical attention—will there be out-of-pocket costs? Are guides licensed and insured? A reputable provider will not hesitate to supply this information. Transparency in pricing reflects integrity in service, and that’s the foundation of financial safety when planning an international study experience.

Why Emotional Spending Undermines Smart Planning

One of the most powerful yet invisible forces in family finance is emotional spending, especially when it comes to children’s education. The idea that a study tour could open doors to top universities or build lifelong confidence makes it easy to justify high costs. Marketing materials often amplify this by showing smiling students at famous landmarks, engaging in hands-on science labs, or presenting research to experts. These images tap into parental hopes and dreams, creating a sense of urgency—“If I don’t do this now, my child might miss a critical opportunity.”

This emotional appeal is not accidental. Many educational travel companies use psychological triggers such as scarcity (“only 3 spots left!”), social proof (“85% of students from top schools choose our program”), and authority (“partnered with Ivy League institutions”) to influence decisions. While some claims may be true, others are exaggerated or lack verification. The danger lies in how quickly these messages bypass rational thinking. A mother in Ohio shared that she paid a $2,000 deposit within 24 hours of seeing a webinar, fearing her daughter would lose her spot—even though they hadn’t reviewed their budget or compared alternatives.

Emotional spending often leads to financial strain because it shifts focus from long-term stability to short-term satisfaction. When parents act out of fear of missing out or peer pressure, they may overlook more affordable options or delay important savings goals like college funds or home repairs. To counteract this, it helps to establish a decision-making window—such as waiting 72 hours before signing any agreement—and involving another adult in the review process. Writing down the reasons for pursuing a specific tour, along with potential risks and alternatives, brings clarity. Recognizing that love for a child doesn’t require overspending is a crucial step toward responsible financial stewardship.

Evaluating Providers: Beyond the Glitz

Not all study tour organizers operate with the same standards. Some are run by experienced educators with strong safety protocols and transparent operations, while others are for-profit ventures focused more on sales than student outcomes. Choosing the right provider means looking beyond glossy brochures and celebrity endorsements. Instead, families should evaluate credibility through concrete indicators such as organizational history, staff qualifications, contract terms, and participant feedback.

A trustworthy provider will clearly state whether they are licensed to operate educational travel programs and whether their guides hold valid certifications in first aid, child safety, and local history. They should also disclose affiliations with schools, universities, or professional associations. For example, a program that lists partnerships with accredited institutions should be able to provide contact information or official documentation upon request. If these details are vague or unavailable, that’s a red flag.

Another critical area is the contract. A well-drafted agreement will outline cancellation policies, refund schedules, liability coverage, and procedures for handling emergencies. Be cautious of contracts that require full payment upfront or offer little flexibility if plans change. Some families have reported losing thousands because the fine print stated “no refunds after 60 days,” even when the student was unable to travel due to illness. A responsible provider understands that life events happen and builds reasonable protections into their terms.

Reading reviews from past participants and parents can also reveal patterns about reliability and service quality. Look for consistent comments about communication, safety, and value. If multiple families mention last-minute changes, poor accommodations, or unresponsive staff, take those warnings seriously. Word-of-mouth and online testimonials aren’t perfect, but they offer real-world insights no brochure can match. Ultimately, choosing a provider is not just about the destination—it’s about trusting the organization with your child’s well-being and your family’s financial health.

Smart Payment Strategies That Reduce Risk

Paying for a study tour doesn’t have to mean writing a large check all at once. In fact, doing so increases financial risk, especially if circumstances change before departure. A smarter approach is to use staged payments tied to specific milestones in the planning process. For example, an initial deposit might secure a spot, followed by a second payment upon visa approval, and a final installment after flight confirmation. This structure ensures that families only pay more as key conditions are met, reducing exposure to loss if the trip is canceled or delayed.

Negotiating payment terms is often possible, even with established providers. Some organizations are willing to create customized plans for families who need flexibility. Spreading payments over several months can make the cost more manageable and prevent strain on household budgets. When discussing options, ask whether interest-free installments are available and whether late fees apply. Knowing these details helps avoid surprises later.

How you pay matters just as much as when you pay. Using a credit card for deposits and balance payments offers important consumer protections under federal law. Most credit issuers allow disputes if services are not delivered as promised, which can be crucial if a provider goes out of business or fails to honor commitments. In contrast, wire transfers or cash payments offer little to no recourse if something goes wrong. One family lost $4,200 when a third-party organizer disappeared after collecting full payment via bank transfer—a loss that could have been avoided with credit card use.

Additionally, avoid pressure to pay in full early, even if offered a small discount. That savings may not be worth the loss of flexibility. Instead, prioritize security and transparency. Confirm whether funds are held in escrow or protected by a financial guarantee. Reputable programs often partner with banks or travel protection firms to safeguard payments. By treating the payment process as part of the overall risk management strategy, families can move forward with confidence, knowing their money is protected at every stage.

Insurance That Actually Works When You Need It

Many families assume that standard travel insurance covers all aspects of a study tour, but this isn’t always the case. Basic policies may cover trip cancellation due to illness, but exclude academic-related disruptions such as school delays, exam rescheduling, or family emergencies that prevent a student from joining mid-program. Others may lack adequate medical coverage abroad, leaving families responsible for costly hospital bills in case of injury or illness.

The right insurance plan for a study tour should include several key features. First, trip interruption coverage that applies not only to the student but also to immediate family members—because a parent’s hospitalization should not result in non-refundable losses. Second, medical evacuation and 24/7 emergency support services, especially important in remote or international locations. Third, academic delay protection, which allows for rescheduling without penalty if a student must return home temporarily. Finally, mental health support access, recognizing that some students may experience anxiety or adjustment challenges while abroad.

Choosing insurance requires careful reading of the policy wording, not just the price tag. The cheapest option is rarely the most comprehensive. Parents should compare plans side by side, focusing on exclusions and claim procedures. Does the insurer require pre-authorization for medical treatment? How quickly are claims processed? Is there a helpline available in multiple languages? These details matter when help is needed most.

Some study tour providers include basic insurance in their package, but families should still review what’s covered. If gaps exist, purchasing supplemental coverage through a trusted provider may be worthwhile. Independent travel insurance companies often offer customizable plans tailored to educational trips. While this adds to the upfront cost, it provides peace of mind that real protection is in place. Remember: insurance isn’t an expense—it’s a safeguard that preserves your investment and your child’s safety.

Building a Realistic Budget—From Start to Return

A realistic budget is the cornerstone of financial preparedness for any study tour. Too often, families focus only on the program fee and overlook other essential costs. A comprehensive budget should include not just the tour price, but also visa application fees, passport renewal, required vaccinations, luggage, adapters, daily spending money, tips for guides, and a contingency fund for emergencies. One family underestimated these additional costs by nearly $1,200, forcing them to borrow money just two weeks before departure.

Start by listing every possible expense, no matter how small. Research visa costs for the destination country and check whether multiple entries are needed. Look into health requirements—some countries mandate specific vaccines, which may not be covered by standard insurance. Consider the cost of communication tools, such as an international SIM card or messaging app subscription, to stay in touch. Daily allowances vary by location; $20 per day may be generous in one country but insufficient in another. Using past travelers’ expense reports or online forums can help estimate realistic amounts.

Include a buffer of at least 10–15% of the total projected cost to account for unforeseen needs. This fund can cover everything from lost belongings to last-minute transportation changes. It also reduces stress, knowing there’s a financial cushion if something unexpected arises. Track all expenses in a shared document or spreadsheet so both parents can monitor progress and adjust as needed.

Begin saving early, ideally setting up a dedicated account for the trip. Automatic monthly transfers—even small ones—build momentum and reduce the burden later. If the full amount isn’t achievable without compromising other goals, consider adjusting plans: choosing a shorter program, a closer destination, or delaying the trip by a year. Financial readiness isn’t about spending everything—it’s about making thoughtful choices that align with your family’s overall stability.

When to Walk Away—Knowing Your Limits

There comes a point in every financial decision where prudence must outweigh desire. No matter how compelling a study tour sounds, if it requires taking on debt, draining emergency savings, or sacrificing essential household needs, it may not be the right choice—at least not right now. True responsibility means recognizing limits and acting accordingly, even when it’s difficult.

Some families feel guilt or shame when deciding not to pursue a program, worried they’re holding their child back. But protecting long-term financial health is not a failure—it’s an act of care. A child’s education doesn’t depend on a single trip. Local museums, library programs, volunteer opportunities, and online courses can provide meaningful learning experiences at a fraction of the cost. In some cases, schools offer scholarships or fundraising support for study tours, making participation possible without personal strain.

Walking away from a program doesn’t mean giving up—it means choosing wisely. It allows families to preserve resources for future opportunities, whether that’s college tuition, home ownership, or unexpected medical needs. It also models healthy financial behavior for children, showing them that thoughtful planning and self-control lead to lasting security. There’s no award for spending the most; the real success is knowing you made a decision based on clarity, not pressure.

Setting personal boundaries starts with honest conversations. Discuss the full cost, risks, and trade-offs with your partner and your child. Explain why certain choices are being made and involve them in alternative planning. This builds understanding and resilience, teaching valuable lessons about priorities and delayed gratification. Saying “not now” leaves the door open for “later,” under better circumstances.

Study tours can be transformative—but only if families approach them with eyes wide open. By prioritizing transparency, planning, and emotional discipline, it’s possible to gain the benefits without the financial fallout. The smartest investment isn’t just in the trip, but in the peace of mind that comes from knowing you’ve protected what matters most.