How I Survived a Debt Crisis Without Losing My Mind

I used to lie awake at night, staring at the ceiling, my phone screen glowing with overdue balance alerts. The debt crisis hit me like a storm I never saw coming. I felt trapped, ashamed, and completely clueless. But over time, I found a way out — not with magic tricks, but with real, tested choices that prioritized risk avoidance and long-term stability. This is how I took control back, one smart move at a time. It wasn’t about sudden windfalls or risky bets. It was about discipline, clarity, and a commitment to doing the next right thing, even when the path ahead felt overwhelming. And if I can do it, so can you.

The Breaking Point: When Debt Stops Being Manageable

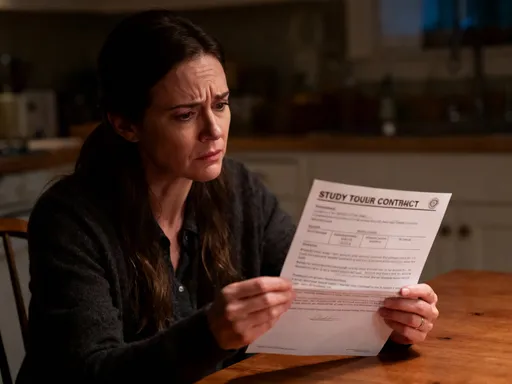

There was a moment — not dramatic, not cinematic, but devastating — when I realized I wasn’t just living paycheck to paycheck. I was drowning. It started with small oversights: a credit card payment delayed by a few days, a utility bill pushed to next month, a grocery run charged because the checking account was low. At first, these felt like temporary fixes, minor adjustments to a tight budget. But over time, the small deferrals piled up, like sandbags failing one by one during a flood. The wake-up call came when I opened my monthly statement and saw a total that made my breath catch. The number wasn’t just high — it was impossible. I had crossed a line where interest charges were growing faster than my ability to pay them down. Minimum payments no longer covered the interest, let alone the principal. I was no longer managing debt — I was feeding it.

The emotional toll was just as heavy as the financial one. Shame became a constant companion. I avoided checking my email, dreading creditor notifications. I stopped answering calls from unknown numbers, knowing they likely weren’t good news. I felt isolated, convinced I was the only one struggling, even as I watched friends post about vacations and home renovations. The truth was, many of them were probably carrying their own silent burdens. But in that moment, my struggle felt uniquely personal, a failure of character rather than a consequence of systemic pressures and unexpected life events. I had lost my job during a company restructuring, and while I eventually found new work, the income was lower, and the gap had already been filled with credit. That gap became a canyon.

Looking back, I can see the warning signs I ignored. The first was lifestyle creep — spending slightly more as income increased, never building a buffer. The second was relying on credit for emergencies instead of savings. The third was avoiding regular financial check-ins, treating money like something to be managed only when crisis struck. These weren’t reckless choices made in malice, but small decisions made without foresight. And collectively, they created a perfect storm. The breaking point wasn’t one event — it was the cumulative weight of ignoring reality. But that moment of clarity, painful as it was, became the foundation of my recovery. Because you can’t fix what you won’t face. And for the first time, I was ready to look.

Facing Reality: Mapping the Full Financial Picture

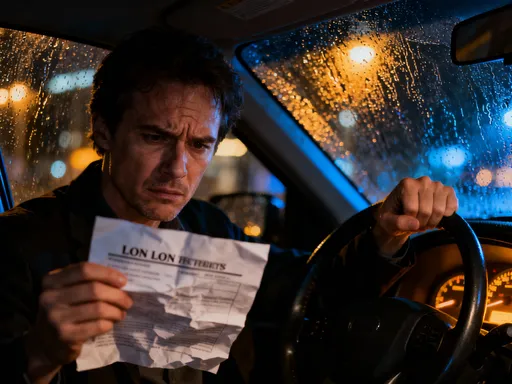

The first real step toward recovery wasn’t paying off a bill or cutting a subscription. It was gathering every piece of paper, logging into every account, and writing down the full scope of what I owed. This wasn’t just about numbers — it was about honesty. For months, I had been avoiding the truth, hoping the problem would shrink on its own. But debt doesn’t disappear when ignored. It grows. So, I sat down with a notebook and a deep breath and began the inventory. I listed every credit card, medical bill, personal loan, and outstanding balance. I noted the creditor, the current balance, the interest rate, the minimum payment, and the due date. I included debts I had mentally minimized — the $300 owed to a friend, the $150 medical co-pay pushed aside. Every dollar counted.

When the list was complete, I totaled the amounts. Seeing the sum in black and white was jarring, but also strangely liberating. It was no longer a vague, shapeless fear. It was a number. And numbers, no matter how large, can be worked with. I could now see which debts were the most dangerous — not necessarily the largest in balance, but the highest in interest. One credit card, nearly maxed out, carried a rate of 26.99%. Another, opened during a period of denial, was at 24.99%. These were not just expenses — they were financial accelerants, burning through my future income at an alarming rate. I also mapped my monthly income and essential expenses: rent, utilities, groceries, transportation, insurance. This revealed my true cash flow — how much was coming in, how much was going out, and how little was left for debt repayment.

This exercise did more than inform a plan — it shifted my mindset. Denial had been my default for so long that facing the full picture felt like a form of courage. I stopped minimizing, stopped making excuses, stopped pretending I would “figure it out later.” The data didn’t judge me — it simply showed me where I stood. And from that neutral ground, I could begin to build a strategy. I realized that emotional responses — panic, guilt, avoidance — had only made the situation worse. A clear, factual assessment removed the fog. It allowed me to stop reacting and start responding. This wasn’t about blame. It was about responsibility. And with that responsibility came power. I wasn’t helpless. I had information. And with information, I could make decisions that reduced risk rather than increased it.

Stopping the Bleeding: Emergency Measures That Actually Work

Once I understood the full scope of my debt, the next priority was clear: stop making it worse. I needed to halt the financial bleeding before I could begin healing. This didn’t mean punishing myself with extreme austerity. In fact, I knew that overly restrictive budgets often fail because they’re unsustainable. Instead, I focused on identifying non-essential spending that could be paused without causing additional stress. I reviewed my bank statements from the past three months and categorized every expense. Some cuts were obvious: monthly subscriptions I rarely used, dining out more than twice a week, impulse purchases made during stressful moments. Others were subtler — premium grocery items, delivery fees, convenience purchases made when tired or short on time.

I created a temporary “crisis budget” that covered only essentials: housing, utilities, basic groceries, transportation to work, and minimum debt payments. Everything else was suspended. I didn’t eliminate joy entirely — I allowed a small personal allowance each week for coffee or a book — but I removed financial leakage. This wasn’t about deprivation; it was about redirection. Every dollar saved from these cuts went into a dedicated debt repayment fund. Within two months, this simple reallocation freed up nearly $400 per month — money that had previously vanished without impact.

At the same time, I reached out to my creditors. This was one of the hardest steps, driven by fear of judgment or rejection. But I learned that many lenders have hardship programs for borrowers in distress. I called each one, explained my situation honestly, and asked about options. Some reduced my interest rate temporarily. Others agreed to lower minimum payments or defer a month’s payment without penalty. One offered a fixed-rate repayment plan over 36 months. These weren’t favors — they were business decisions. Lenders would rather receive partial payments consistently than risk default. By communicating early and transparently, I avoided late fees, reduced interest accrual, and protected my credit score from further damage. I also paused retirement contributions temporarily. This felt counterintuitive, but with high-interest debt growing rapidly, the math was clear: paying down 24% interest was a better return than any market gain I might earn. This was a tactical pause, not a permanent abandonment of long-term goals.

Building the Shield: Prioritizing Risk Avoidance Over Quick Fixes

During my crisis, I was bombarded with tempting solutions. Ads promised instant debt relief, balance transfer cards with 0% interest for 18 months, payday loans with “easy approval.” On the surface, they seemed like lifelines. But I had learned the hard way that quick fixes often come with hidden costs. I chose instead to build a financial shield — a strategy centered on stability, not speed. My first rule was absolute: no new debt. That meant saying no to new credit cards, store financing, and even “harmless” personal loans from friends. Each new obligation, no matter how small, increased my risk exposure and delayed true recovery.

I also resisted the urge to chase high-risk income streams. I didn’t sell my car, take a second job in an unstable gig, or invest my last savings in a “sure thing” side hustle. These options might have brought short-term cash but could have led to greater instability. Instead, I focused on protecting what I had. I maintained my health insurance, kept up with car maintenance, and avoided moves that would incur additional fees. These choices weren’t glamorous, but they prevented new emergencies from compounding the old ones.

Another key part of my shield was rebuilding a small emergency fund — not a full three-to-six-month reserve, but a starter buffer of $1,000. This might seem counterintuitive when drowning in debt, but it served a critical purpose: it prevented me from using credit cards for unexpected expenses. A flat tire, a medical co-pay, a broken appliance — these were no longer financial disasters. They were manageable costs. This buffer reduced stress and eliminated the cycle of “emergency → credit card → higher debt.” It was a small act of self-protection that paid long-term dividends. I funded it slowly, $20 at a time, but its psychological impact was enormous. I no longer felt one accident away from collapse. I had a margin of safety. And in financial recovery, safety isn’t optional — it’s the foundation.

The Paydown Playbook: Strategy Over Speed

With the bleeding stopped and my shield in place, I turned to the actual work of paying down debt. I researched the two most common strategies: the avalanche method, which targets the highest-interest debt first, and the snowball method, which focuses on the smallest balances to build momentum. The avalanche method saves more money in interest over time, while the snowball method offers psychological wins that can sustain motivation. After careful consideration, I adopted a hybrid approach — one that balanced financial efficiency with emotional sustainability.

I started with the snowball method for my first three debts: a $150 medical bill, a $300 personal loan, and a $200 credit card balance. These were small, but their presence weighed on me. By throwing all available extra funds at the smallest balance first, I paid it off in six weeks. That first paid-in-full notification was a turning point. It proved I could win. I celebrated — modestly, with a home-cooked meal — and rolled the payment from the first debt into the next. Within three months, all three were gone. The momentum was real. Each small victory made the next challenge feel less daunting.

Then, I switched to the avalanche method. My remaining debts included two credit cards with high interest rates — one at 26.99% and another at 22.99%. Mathematically, it made sense to attack the 26.99% card first, even if the balance was larger. I calculated the total interest I would save by focusing on high-rate debt and used that number as motivation. I set up automatic payments above the minimum and tracked progress monthly. This phase was slower, less flashy, but deeply satisfying. I could see the interest charges shrinking, the principal declining faster. I wasn’t just paying — I was winning back control.

This hybrid strategy worked because it respected both logic and human nature. The early wins built confidence. The later focus on interest saved money. And by avoiding burnout — a real risk when repayment takes years — I stayed consistent. I didn’t rush. I didn’t skip steps. I followed the plan, adjusted when needed, and trusted the process. Debt repayment isn’t a sprint. It’s a marathon with obstacles. But with the right strategy, it’s one you can finish.

Earning Smarter: Income Growth Without High Stakes

While cutting expenses helped, I knew that long-term recovery required more than just spending less. I needed to increase my income — but in ways that didn’t jeopardize my stability. I ruled out high-risk ventures: day trading, multi-level marketing schemes, or quitting my job to start a business with no capital. Instead, I focused on sustainable, low-barrier opportunities that leveraged skills I already had.

I began by upskilling during evenings and weekends. I took a certified online course in digital administration, which improved my efficiency at work and made me eligible for a modest raise. I didn’t demand it — I demonstrated value first, then asked. The increase was only 8%, but over a year, it added nearly $3,000 to my income — enough to accelerate my debt payoff by several months. I also explored side gigs that required little to no upfront investment. I offered virtual assistant services to small business owners, managed email inboxes, scheduled appointments, and organized digital files. I used free platforms to find clients and set clear boundaries to protect my time and energy.

Another source of income came from underused assets. I rented out a spare room in my home through a trusted local network, not a high-traffic platform that might attract unreliable tenants. The extra rent covered a full debt payment each month. I also sold gently used clothing, books, and electronics I no longer needed. These weren’t windfalls, but steady streams of supplemental income that made a real difference. The key was consistency — earning an extra $200 a month reliably was more valuable than $500 once and then nothing for months.

Most importantly, I committed to directing all extra income toward debt until it was gone. No “treating myself” with windfalls. No lifestyle inflation. Every dollar earned beyond my baseline went into the repayment plan. This discipline wasn’t easy, but it was temporary. And the payoff — financial freedom — was worth the delay.

Staying Free: Habits That Prevent Relapse

Paying off the last debt was a moment of profound relief, but I knew the journey wasn’t over. True freedom wasn’t just the absence of debt — it was the presence of habits that prevented its return. I had learned that financial health isn’t a destination; it’s a daily practice. So, I built systems to protect my progress. I maintained a zero-based budget, where every dollar had a job — savings, expenses, debt repayment, or giving. I reviewed it weekly, adjusting as needed. This wasn’t restrictive — it was empowering. I knew where my money went, and I made choices intentionally.

I also established spending rules. For any purchase over $100, I imposed a 48-hour waiting period. This simple pause eliminated impulse buys and allowed me to assess whether the purchase aligned with my values and goals. I continued building my emergency fund until it covered three months of essential expenses. I automated transfers to savings so that discipline didn’t rely on willpower. I also scheduled quarterly “money dates” — time to review my financial health, check credit reports, and reset goals. These weren’t chores — they were acts of self-respect.

Perhaps the most important change was internal. I no longer saw money as a source of shame or anxiety. I saw it as a tool — neutral, powerful, and manageable. I talked openly about my journey with trusted friends, not to boast, but to normalize the conversation around debt. I learned to celebrate progress, not perfection. And when setbacks occurred — a car repair, a medical bill — I handled them from a place of preparedness, not panic. I used savings, not credit. I adjusted the budget, not my mindset.

Freedom Is a Practice, Not a Finish Line

Looking back, escaping the debt crisis wasn’t about a single heroic act. It was about hundreds of small, consistent choices — each one prioritizing long-term stability over short-term relief. It was about facing reality instead of running from it, building protection instead of chasing risk, and valuing progress over perfection. The numbers mattered, but so did the mindset. I didn’t just pay off debt — I rebuilt my relationship with money. I learned that financial peace isn’t found in wealth, but in wisdom. It’s not about how much you earn, but how you manage, protect, and grow what you have. Today, I sleep through the night. My phone doesn’t light up with alerts. But more than that, I feel capable. I feel free. And that freedom isn’t fragile — it’s fortified by habits, systems, and a deep commitment to doing the next right thing. This isn’t the end of my financial journey. It’s the foundation of a life built on clarity, control, and quiet confidence. And that, more than any number, is the real victory.