How I Turned Sports Training Costs into Smart Investments

Paying for sports training used to feel like money down the drain—until I realized it could be more than just an expense. What if those fees weren’t just costs, but stepping stones to long-term value? I started seeing education in athletics differently: not as a burden, but as a hidden path to personal and financial growth. This shift changed everything—from how I budget, to how I plan for the future. The realization didn’t come overnight. It emerged gradually, through years of balancing checkbooks, attending early-morning practices, and watching young athletes grow not just in skill, but in character. Once I began treating sports training as a form of investment rather than a recurring cost, the financial and emotional returns began to reveal themselves in meaningful ways.

The Hidden Cost of Sports Training: More Than Just Fees

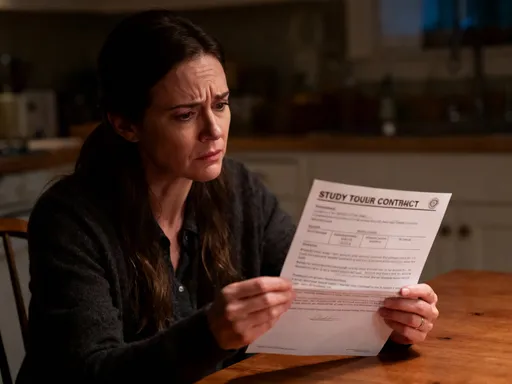

When families enroll their children in sports programs, the most visible expense is often the monthly coaching fee. However, this is only the surface of a much deeper financial and emotional commitment. Beyond tuition, there are travel costs, equipment upgrades, competition entry fees, and the often-overlooked value of time—hours spent driving to practices, waiting on sidelines, and managing schedules. For many parents, particularly those in dual-income households or single-parent families, these demands can strain both budgets and relationships. What begins as a supportive decision for a child’s physical health and social development can quickly feel like an unrelenting financial drain.

Yet, the true cost of sports training isn’t just monetary—it’s opportunity cost. Every dollar spent on a specialized training camp is a dollar not saved for college, not invested in a retirement fund, and not allocated toward home improvements or emergency reserves. The hours dedicated to training are hours not spent on career advancement, household maintenance, or personal rest. Recognizing this reality is the first step toward redefining how families approach youth sports. Instead of viewing these expenses as inevitable, forward-thinking families are beginning to assess them through the lens of return on investment. Are the skills being developed transferable? Is there a measurable outcome tied to long-term benefits such as scholarships, career opportunities, or personal discipline?

Over time, I observed that the most valuable outcomes of sports training were not always reflected in win-loss records or personal bests. They appeared in the quiet moments: a teenager managing homework between practices, a child learning to handle defeat with grace, a family unit growing stronger through shared goals. These intangible gains—resilience, time management, emotional regulation—are not just character traits; they are life assets with long-term financial implications. A disciplined athlete is more likely to become a focused student, a reliable employee, and a responsible decision-maker. When viewed through this broader lens, the cost of training transforms from a sunk expense into a strategic investment in human capital.

Asset Appreciation Through Athletic Development

In financial terms, an asset is something that has the potential to increase in value over time. A home, a stock portfolio, or a college education can all appreciate under the right conditions. Similarly, athletic development can function as a form of human capital appreciation when nurtured strategically. The early years of training are like the initial deposits into a compound interest account—the effort may seem small at first, but with consistency and quality guidance, the returns grow exponentially. This is not to suggest that every young athlete will become a professional or earn a full scholarship, but rather that structured athletic development can yield measurable financial and personal benefits over time.

One of the most tangible forms of appreciation is access to college funding. According to data from the National Collegiate Athletic Association (NCAA), over $3.6 billion in athletic scholarships are awarded annually across Division I, II, and III institutions. While only a small percentage of high school athletes receive full scholarships, many more benefit from partial awards, academic-athletic packages, or preferential admissions that reduce overall education costs. For families facing rising tuition fees, even a modest athletic scholarship can translate into tens of thousands of dollars in savings over four years. The key is not simply participation, but strategic engagement—choosing programs with a history of placing athletes in collegiate systems, working with coaches who understand recruitment timelines, and maintaining eligibility through academic performance.

Beyond scholarships, athletic training can open doors to professional opportunities in fields such as coaching, sports medicine, physical therapy, and fitness entrepreneurship. The skills developed through competition—leadership, teamwork, goal setting—are highly transferable to the workforce. Employers often value candidates with athletic backgrounds because they demonstrate discipline, perseverance, and the ability to perform under pressure. In this way, the investment in training extends far beyond the playing field, influencing career trajectories and earning potential. When families treat athletic development as an asset class, they begin to make more informed decisions about where and how to allocate resources, ensuring that each dollar spent contributes to long-term growth rather than short-term gratification.

Turning Passion into Long-Term Value

Passion is the engine that drives athletic commitment. It motivates early mornings, powers through setbacks, and sustains focus during grueling training cycles. However, passion alone is not enough to ensure long-term success or financial sustainability. Without strategic planning, even the most dedicated athletes can find themselves burned out, injured, or unprepared for life after sports. I learned this lesson firsthand when a close family member committed to competitive swimming. Initial enthusiasm led to enrollment in multiple clinics, private lessons, and travel meets—each with its own price tag. While improvement was evident, the financial strain became unsustainable.

That’s when we shifted our approach. Instead of reacting to every opportunity, we developed a structured plan aligned with long-term goals. We identified key milestones—qualifying times, championship seasons, recruitment windows—and built a training calendar that prioritized high-impact activities. We focused on working with certified coaches who had a proven track record of developing collegiate-level swimmers, rather than spreading resources across multiple low-yield programs. This wasn’t about cutting corners; it was about maximizing value. By treating each season as a phase in a multi-year investment strategy, we ensured that progress was measurable, purposeful, and financially responsible.

The benefits extended beyond the pool. The discipline required for rigorous training translated into improved academic performance. Time management skills honed through balancing school and practice schedules became lifelong habits. Networking opportunities emerged through team affiliations, alumni connections, and coach recommendations. These indirect returns—often overlooked in traditional cost-benefit analyses—proved to be among the most valuable. Passion, when paired with intentionality, becomes a powerful financial lever. It transforms a personal interest into a platform for growth, opening doors that might otherwise remain closed. Families who adopt this mindset are not just supporting a sport—they are cultivating a future.

Risk Management in Sports Investment

Like any investment, athletic development carries inherent risks. The most obvious is the physical risk of injury, which can derail progress, incur medical costs, and shorten a competitive career. Equally significant are the emotional and financial risks of overcommitment. I’ve seen families pour years of income and energy into a single sport, only to face disappointment when a child loses interest, suffers burnout, or fails to meet performance benchmarks. In some cases, academic performance suffers, limiting future options outside of athletics. These outcomes are not failures of effort—they are symptoms of inadequate risk management.

To protect against these risks, families must adopt a diversified approach. Just as financial advisors recommend spreading investments across asset classes to reduce exposure to any single market, parents should encourage balanced development across multiple domains. Maintaining strong academic performance ensures that opportunities remain open even if an athletic path doesn’t materialize. Encouraging participation in other interests—music, debate, community service—builds a well-rounded profile that enhances college applications and career readiness. This is not about diluting focus, but about creating resilience. An athlete who excels both in the classroom and on the field is better positioned to navigate uncertainty and adapt to changing circumstances.

Additional safeguards include securing appropriate insurance, such as health coverage that includes sports-related injuries, and considering supplemental policies that protect against training interruptions. Flexible training plans that allow for periodic reassessment help prevent burnout and ensure alignment with evolving goals. Mental health support is also a critical component of risk management. The pressure to perform can take a toll on young athletes, and access to counseling or performance coaching can make a significant difference in long-term well-being. By treating sports investment with the same level of caution and planning as any other financial decision, families can mitigate risk while still pursuing excellence.

Practical Budgeting for Sustainable Growth

Smart financial management begins with clear, realistic budgeting. In the context of sports training, this means moving beyond reactive spending—paying fees as they arise—and adopting a proactive, strategic approach. I started by creating an annual sports budget, treating it with the same seriousness as housing, groceries, or education expenses. This budget included fixed costs such as coaching fees and equipment, variable costs like travel and competition entries, and a contingency line for unexpected expenses such as injury treatment or last-minute registration changes.

The next step was prioritization. Not all expenses contribute equally to long-term value. High-quality coaching from certified professionals, access to proper facilities, and participation in well-organized competitions deliver measurable returns. In contrast, premium apparel, unnecessary supplements, or low-impact clinics often provide little developmental benefit relative to their cost. By distinguishing between essential and discretionary spending, we were able to redirect funds toward higher-impact areas without reducing overall progress. This wasn’t about cutting corners—it was about spending with purpose.

Many families find creative ways to stretch their budgets. Some open dedicated savings accounts specifically for athletic development, allowing funds to grow over time. Others explore tax-advantaged education savings plans, such as 529 accounts in the United States, which can be used for qualified educational expenses, including some forms of vocational training that may align with sports-related careers. Bartering services—such as offering graphic design or administrative support in exchange for reduced fees—is another option available in certain community programs. Team co-ops, where families pool resources to hire coaches or rent facilities, can also reduce individual costs while building stronger team cohesion. The goal is not to spend less, but to spend wisely—ensuring that every dollar contributes to sustainable, long-term growth.

Measuring Returns Beyond the Balance Sheet

Traditional financial investments are evaluated using clear metrics: interest rates, stock prices, property values. Athletic investments, however, require a broader framework for measuring success. While scholarships and recruitment offers are tangible returns, the most significant gains often appear in less quantifiable forms. Confidence, work ethic, leadership, and emotional resilience are intangible assets that compound over time, influencing decisions, relationships, and career outcomes. A young athlete who learns to set goals, manage setbacks, and collaborate under pressure is developing skills that will serve them long after their competitive years end.

I now evaluate progress using a dual framework: performance metrics and personal development indicators. Race times, rankings, and skill assessments provide objective data on athletic growth. But I also track improvements in focus, responsibility, and communication. When a former teammate secured a job through a connection made at a national competition, it reinforced the idea that the network built through sports has real-world value. These relationships—forged through shared challenges and mutual respect—can lead to mentorship, internships, and career opportunities that extend far beyond athletics.

The true return on investment is not always immediate, but it is enduring. Studies have shown that individuals with athletic backgrounds are more likely to exhibit leadership qualities in professional settings and report higher levels of job satisfaction. They are also more likely to maintain healthy lifestyles, reducing long-term healthcare costs. When families begin to measure success not just by trophies, but by the development of capable, resilient individuals, they gain a more complete picture of the value being created. This holistic approach allows for more informed decision-making and greater peace of mind, knowing that the investment is yielding returns on multiple levels.

Building a Legacy, Not Just a Season

The ultimate measure of any investment is its lasting impact. In the context of youth sports, the goal should not be limited to winning a championship or achieving a personal best. It should be about building a foundation for lifelong success—financial, personal, and social. Families who approach sports training as part of a broader development strategy often see ripple effects across generations. The discipline learned on the field becomes the work ethic applied in the workplace. The financial habits established through budgeting for training support future wealth-building. The values of teamwork and perseverance shape family culture and community involvement.

By reframing sports not as an expense but as a strategic investment, families do more than fund training—they fund futures. They teach children that effort, when directed with purpose, leads to growth. They model responsible financial behavior, showing that even passionate pursuits must be balanced with long-term planning. They create a legacy of resilience, where challenges are seen as opportunities and setbacks as lessons. This mindset transcends athletics, influencing how future generations approach education, careers, and personal goals.

The journey from viewing sports as a cost to recognizing it as an investment is not always easy. It requires patience, discipline, and a willingness to look beyond immediate results. But for those who make the shift, the rewards are profound. What once felt like money disappearing into fees becomes a structured path toward empowerment, opportunity, and lasting value. In the end, the most valuable return is not a scholarship or a trophy—it is the transformation of a young person into a capable, confident, and financially aware adult. That is the true meaning of asset appreciation.